Tax Changes For 2011

'Stealth' income taxes - Affluent taxpayers won't have deductions clipped by the so-called Pease and PEP limitations. The Pease limit cut 3% of itemized deductions and PEP eroded the personal exemption, which is $3,700 for 2011. Expires: end of 2012.

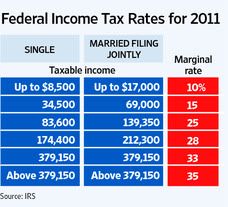

Investment taxes - Rates continue at historic lows for both long-term capital gains and dividends. For taxpayers in the 15% income tax bracket and below, the rate is zero. For those in the 25% bracket and above, the rate is 15% (see table). Expires: end of 2012.

Estate and gift taxes - The system has been overhauled, with a top rate of 35% and one exemption of $5 million per individual for estate, gift and generation-skipping taxes alike. For those who can stand to part with assets, it's now possible to shift large amounts of wealth. Expires: end of 2012.

The annual exclusion for tax-free gifts remains $13,000 per donor. A giver may make an unlimited number of $13,000 gifts, as long as they are to different individuals. Gifts of tuition and payments for medical care also are exempt.

Payroll taxes - Last year's big surprise was a temporary two-percentage-point cut in the employee's share of Social Security taxes, saving a maximum of $2,136 per worker. There is no phase-out, and each partner of a married couple can get the rebate. Expires: end of 2011.

For most workers, this cut will come as an automatic adjustment to withholding. For the self-employed (whose tax rate falls to 10.4% from 12.4%), it will be built into a quarterly withholding worksheet the IRS hopes to release soon, says IRS spokesman Eric Smith.

Alternative Minimum Tax (AMT) - The "patch" enacted by Congress sets the AMT exemption at $47,450 for single filers and $74,450 for married couples, slightly higher than for 2010. Expires: end of 2011.

Roth IRA conversion - The income limit for conversions has been permanently removed, so this year all taxpayers may still convert ordinary IRAs into Roth IRAs. But taxpayers who convert to Roth IRAs in 2011 no longer have the option of deferring conversion income into later years, as was true for 2010 conversions. Those who converted in 2010 do have until next Oct. 17 to decide whether to use this deferral.

Foreign-account reporting - A little-noticed provision enacted last year imposes a new IRS reporting requirement on those with foreign financial assets above $50,000 in 2011. This form is different from the foreign asset report known as the FBAR. It will also apply to some, such as hedge-fund investors, who have been exempt from the FBAR filing, according to Michelle Koroghlanian of the American Institute of CPAs. Details remain unclear, as the IRS hasn't yet issued regulations.

Medical expenses - Workers with Flexible Spending Accounts (FSAs) may no longer use pretax funds to pay for many over-the-counter medicinesaside from insulinwithout a prescription. But FSA funds may still be used for other, nonprescription medical items such as crutches, contact-lens solution or a wig after chemotherapy, if the individual plan allows it, notes Melissa Labant of the AICPA. For a list of what is allowed by law, see IRS Publication 502.

Cost-basis reporting by brokers - As of 2011, brokers must track clients' purchases of stock, real-estate investment trusts and foreign securities, and then report the original cost to the IRS when the asset is sold. This is an effort to improve tax compliance by investors. The rules for investments in mutual funds, bonds, options and many exchange-traded funds don't kick in until after 2011. (See Tax Report, Oct. 23, 2010.)

Energy tax credits for homeowners - As part of the December changes, lawmakers extended the "25(C)" credit for energy-efficient improvements, but in a way that will be useful to few. The amount of the credit has shrunk to a maximum of $500 per taxpayer per lifetime, so those who took last year's $1,500 credit under this provision don't qualify. The current version expires at the end of 2011, and builders and remodelers may push either to expand it or drop it altogether.

Other changes - Also renewed at the last minute were the $250 deduction for teacher classroom expenses; a deduction for state sales taxes in lieu of the state income tax deduction; and the tax-free donation of IRA proceeds to charity (Tax Report, 12/18/09). They expire at the end of 2011. The American Opportunity Tax Credit of up to $2,500 for education expenses was renewed for 2011 and 2012.